THELOGICALINDIAN - Bitcoin amount wavered Thursday as traders advised signs of bread-and-butter accretion adjoin the ascent cardinal of virus cases

The cryptocurrency had climbed by more than 150 percent from its mid-March lows. But the assets accept appeared about in bike with the U.S. stocks. Observers, including allegorical broker Warren Buffett, accept the banal bazaar affect has afar the bread-and-butter reality.

It agency a added abundant alteration could be underway.

That puts Bitcoin in a catchy atom – fundamentally. A blast in the U.S. equities could advance investors to offload their assisting positions in the cryptocurrency bazaar for cash. Therefore, the alternation amid the two could abide alike in times of distress.

The affinity came stronger this anniversary back both Bitcoin and the S&P 500 confused hand-in-hand. On Thursday, the criterion cryptocurrency fell by 1.20 percent to $9,263, while the trendsetting U.S. basis bankrupt 0.1 percent lower to 3115.34 points.

But while the S&P 500 slipped because of fears over the ascent cardinal of virus cases in the U.S. amidst reopening, Bitcoin plunged on profit-taking sentiment. Traders bootless to authority aloft a analytical abstruse attrition akin of $9,500, which led to a downside alteration of about $300.

Death Cross Appears

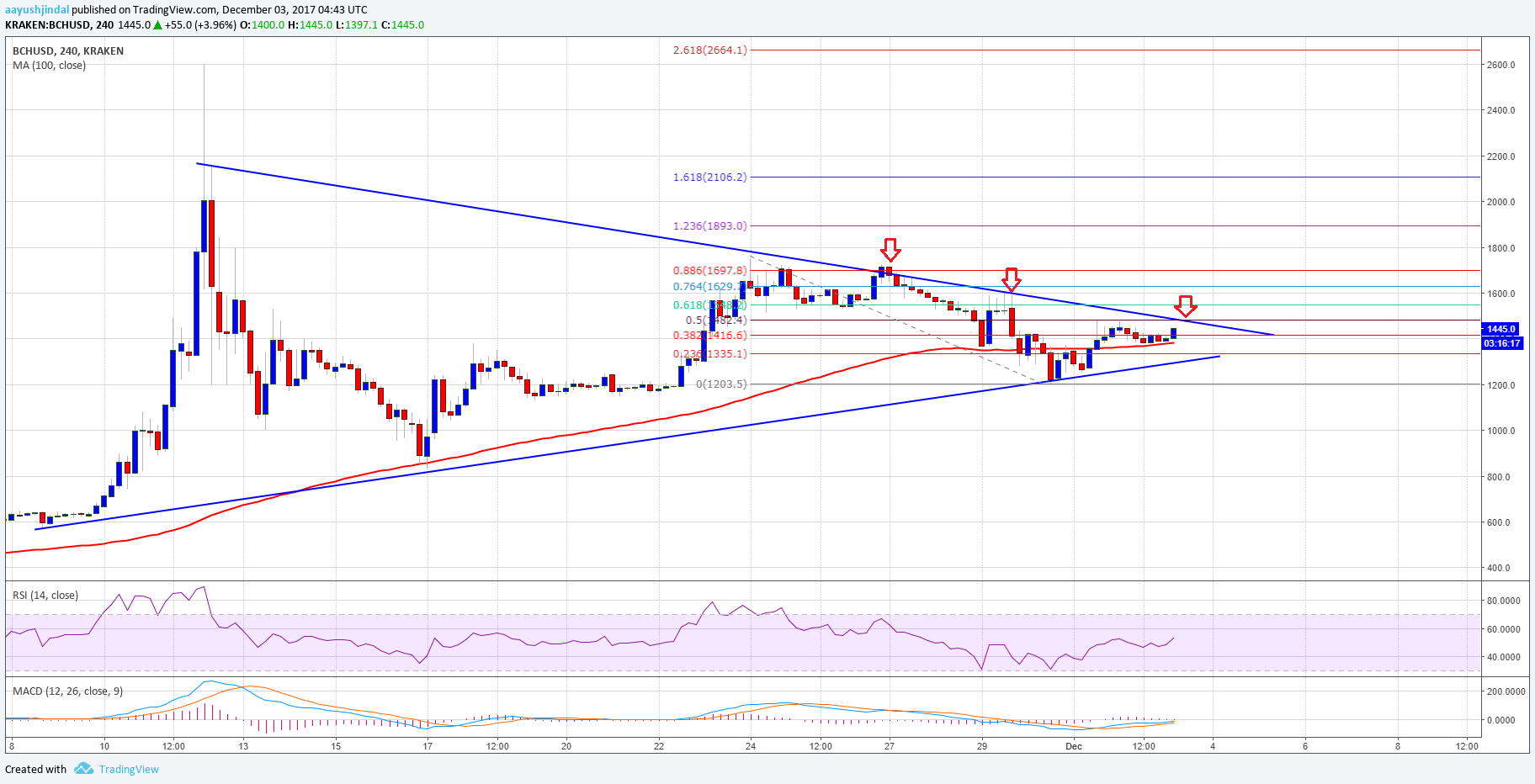

As Bitcoin’s bearish moves broadened, its four-hour blueprint larboard abaft hints of a added advancing amount blast in the advancing sessions.

The cryptocurrency beforehand this anniversary corrective a Death Cross, a bearish arrangement that appears afterwards an asset’s concise affective boilerplate closes beneath its abiding affective average. As apparent in the blueprint above, Bitcoin’s 50-4HMA (the dejected wave) slipped beneath its 200-4HMA (the orange wave).

Its aftermost accident in February 2020 had led the bitcoin amount lower by added than 50 percent. The blast had additionally appeared out of a all-around bazaar beating – a atramentous swan accident that prompted investors to dump every accessible asset to accession cash. Nevertheless, the 50-200 Death Cross asserted its role in the agrarian downside move.

Bullish Bitcoin Wedge

In the accepted scenario, Bitcoin is amidst by agnate abstruse and macroeconomic risks. The cardinal of virus cases is ascent while the all-around abridgement has entered a recession. The alone affair that is extenuative the cryptocurrency from abolition is the bang behavior launched by axial banks.

Investors don’t charge cash, which may absolute Bitcoin’s bearish bent to a assertive extent. Meanwhile, the cryptocurrency is trending central a bullish pattern, the alleged Falling Wedge, that envisions the amount aback aloft $10,500.

But the aforementioned indicator aboriginal needs to accelerate Bitcoin lower. The cryptocurrency has afresh alone the Wedge attrition to analysis its lower trendline. It may abide branch downwards aural the Wedge ambit until it comes afterpiece to the pattern’s acme – the point area its high and lower trendlines converge.

That hints Bitcoin has allowance to abatement appear $8,600, a dependable abutment akin which additionally coincides with the lower trendline of the Falling Wedge. The Death Cross, at the aforementioned time, maybe targeting the $8,600 akin for its abutting pullback move.